March Market Outlook: Tariffs, Jobs, Volatility, and the Path Ahead

- Brad Tremitiere CIO

- Mar 11

- 5 min read

March Market Outlook: What Seasonality, Tariffs, and Volatility Tell Us About the Months Ahead

In our February Market Outlook, we posted the following in regard to the expected performance for the month:

“There is notable weakness in the S&P during the month of February. This weakness is amplified as well when it’s a post-election year, which 2025 is, where the incumbent party loses. In these cases, the month of February produces roughly a -3.00% return before reversing course in early March.”

While the S&P 500 declined by only 1.45% in February, market performance weakened notably during the last two weeks of the month. As expected, this weakness has persisted into March.

According to the Post-Election Seasonal Pattern chart from the Stock Trader’s Almanac, in post-election years where the incumbent party loses, the market typically experiences weakness in late February, often extending into the second week of March. While seasonality doesn’t always align precisely in timing, it is directionally accurate. Historically, March often serves as a bullish turning point in such years.

To understand the current market weakness and heightened volatility, we must first identify the factors contributing to the prevailing "wall of worry" that investors are facing.

Tariffs & Tariffs

Similar to early 2018, the threat of tariffs from the Trump administration has created market uncertainty as investors assess the impact of widespread tariff implementation. The 2025 tariffs include a 25% levy on Canada and Mexico—our two largest trading partners—as well as a doubling of the existing 10% tariffs on China. While many experts question the effectiveness of tariffs, especially on Canada and Mexico, there should be no question that the current state of our economy requires some major changes.

With an unsustainable deficit-to-GDP ratio of 7% and interest payments on Treasury debt consuming approximately 20% of tax revenue, the economy requires significant intervention to address its current challenges. If the proposed tariffs are fully implemented, they are expected to generate roughly $150 billion in revenue in 2025. This additional income would help reduce overall Treasury issuance, which in turn could lower interest rates and create room for further policy action—most notably, the renewal of tax laws set to expire this year.

Looking ahead, we anticipate that tariff discussions will continue to be a source of market concern. However, as seen in 2018, once the market gains a clearer understanding of potential outcomes, the impact of tariffs on daily market performance is likely to diminish over time.

Job Cuts

Job cuts have been rising gradually over the past few months but have accelerated in the last month as the Department of Government Efficiency (DOGE) moves to reduce federal jobs. These efforts to shrink the government workforce have sparked a significant backlash. However, from a historical standpoint, given the hiring levels of the past 30 months, these layoffs may appear justified.

Due to the disruptions caused by the COVID-19 shutdowns in 2020, generating perfectly accurate historical employment data remains challenging. However, we can establish a reasonable estimate. By analyzing monthly government hiring trends from 2010 to 2019 and again from 2021 to mid-2022—excluding the job losses of 2020 caused by shutdowns—we find that, on average, the government added 5,130 net new hires per month over this timeframe.

For reasons that remain unclear, government hiring surged between July 2022 and the end of 2024, averaging over 45,000 new hires per month. Since government employment is funded solely by tax revenues, such a sharp increase adds further strain to an already burdened system struggling with massive interest payment liabilities. Aggravating the issue, government employee wages and benefits reached an all-time high in 2024, even as both metrics have been declining in the private sector since late 2021.

Growth Scare

The first two months of 2025 have been challenging for the growth sector, as the Magnificent 7 and other high-flying equities from last year have fallen back to Earth. With tariffs now in effect and the sudden emergence of a potential AI game-changer in Deep Seek, many experts believe the market is experiencing a potential growth scare. While this concern may be valid—especially given the significant capital pouring into AI—historically, attempts to shift the long-term market trend from growth to value have largely failed over the past decade.

At this stage, we believe it is premature to assume a fundamental shift from the growth-driven market that has fueled returns for years to a value-oriented one. Moving forward, key indicators such as a sharp acceleration in inflation, a return of the personal savings rate to pre-COVID levels, and a rise in non-government unemployment would need to materialize before raising serious concerns about long-term market growth.

Dollar/Yen Currency Pair

To us, the unwinding of the “Yen Carry Trade” is one of the major issues that is not getting enough attention and is likely the reason for much of the weakness the market has experienced over the last couple of weeks. A similar scenario played out last summer when Japan’s second rate hike strengthened the Yen, triggering a massive unwind of leveraged trades and causing an 8.5% drop in the S&P 500 before a rebound.

Now, history is repeating itself. In late January, the Bank of Japan raised rates from 0.25 to 0.50 bps—the highest level since 2008—causing the Yen to strengthen against most global currencies. As a result, growth equities and cryptocurrencies, where the Yen Carry Trade is most leveraged, have suffered. Through the market close on March 7th, we have seen Bitcoin dropped 21.85%, and the Nasdaq ETF (QQQ) is drop about 9.00%, since the Bank of Japan hiked rates on January 24th.

While the Yen Carry Trade is smaller than last summer, its unwinding continues to pressure growth sectors. However, we believe this pressure is nearing an extreme and should reverse soon. Japan's ongoing rate hikes to combat inflation will prolong this issue, but like tariff concerns, market impact will likely fade over time.

Based on the weekly data ending March 7th from the Commodity Futures Trading Commission (CFTC), the chart above shows that the Commercial Traders currently hold their largest NET SHORT position in Yen futures since 2000. The short position increased a massive 34% from the previous week and the current position is the largest short position on record since the CFTC started reporting this data in 1986. Again, it might not happen right away but given the massive size of the current short positions by the Commercial Traders, we would expect the direction of the Yen to change from one of strength to weakness rather soon.

What To Expect For March

March has seen its fair share of unusual market events in recent years—from the COVID crash in March 2020 to the banking crisis of March 2023. Despite these disruptions, March has historically been one of the stronger months for the S&P 500. Even with the steep 12.51% decline in March 2020, the index has averaged a 1.34% monthly return over the past 20 years. Since COVID, March has performed even better, averaging a 3.60% return over the last four years.

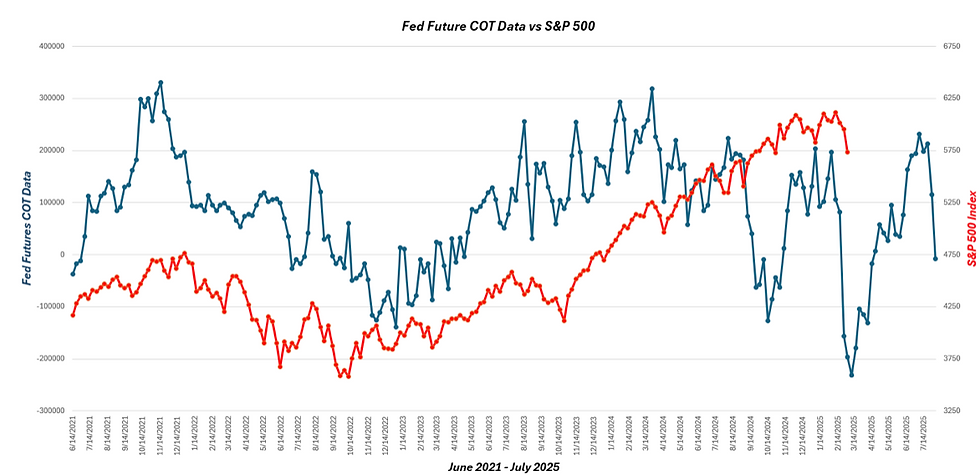

Although the current market weakness makes it difficult to see the broader trend, we believe March will serve as a turning point. Supporting this outlook, the positioning of commercial traders in Yen futures suggests an improvement, while our long-term timing indicator, based on the Fed Future COT data from the CFTC, signals that the market is likely to bottom around the second week of March. From the expected low, we anticipate a period of more stable market conditions over the next four to five months. Of course, anything can and will happen.

For the month of March we expect volatility to remain elevated and for news to continue to drive the market, but there should be a noticeable trend change within the market this month that should lead us into April, which has long been one of the best performing months in the markets.

Hang in there for now.

Brad Tremitiere CIO

Chief Investment Officer - Partner

Financial Advisor

Comments