November Outlook: Post-Election Market Performance

- Brad Tremitiere CIO

- Nov 4, 2024

- 5 min read

Updated: Nov 5, 2024

The Market Usually Manages to Perform Well Regardless of the Election Outcome

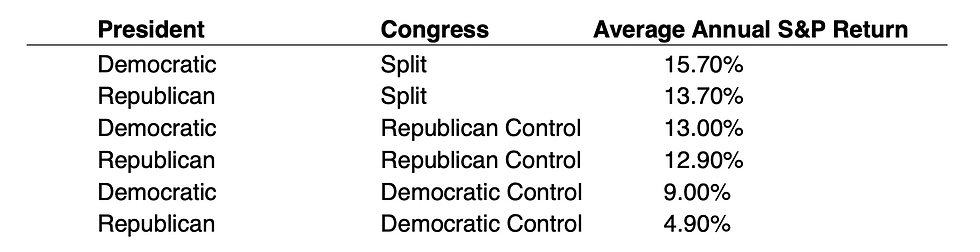

While investors often stress in the weeks leading up to a Presidential Election, the outcome tends to have a limited impact on the market’s annual performance. Post-election market performance is more reliably influenced by the partisan control of Congress rather than the party in the White House. Looking at the average annual performance of the S&P 500 over the last 90 years, below is a breakdown based on the party in the White House and the composition of Congress:

The market often appreciates the gridlock caused by a split Congress, with one party controlling the House and the other controlling the Senate. As we consider this year's election outcomes, here is our current forecast for the Senate and House of Representatives elections:

Senate Elections

Based on the 2024 election map, we estimate a 75-80% probability that the Republican Party will regain control of the Senate. With eight seats open due to retirements, Republicans are positioned to secure key seats in West Virginia and Indiana, potentially reaching at least 51 seats.

House of Representatives

The House elections appear to be a true toss-up, with nearly equal chances for either party to gain control. All 435 congressional districts are up for election, making it challenging to project a clear advantage for either side. This year, there are 45 open seats in the House, but these races do not provide a distinct edge to either party.

Based on Our Expectations, These Are the Three Potential Election Outcomes:

Republican President, Democrat House, Republican Senate

Democrat President, Democrat House, Republican Senate

Republican President, Republican House, Republican Senate

Our Base Case: A Split Congress

Our primary expectation is a split Congress, with Republicans regaining control of the Senate and Democrats taking back the House. This division generally reduces the overall power of the President and requires bipartisan negotiation on key government actions.

The only other potential scenario we foresee is a Republican sweep, which would require strong support for President Trump lifting Republican House candidates. Despite open Senate seats, we do not expect Vice President Harris to gain enough support for Democrats to retain Senate control.

Post-Election Market Performance Expectations

While election-related anxiety typically peaks in the week leading up to the event, the market often experiences a relief rally once the election passes. The chart below shows S&P 500 returns in November and December following each election since 1972. On average, following the last 13 Presidential elections, the S&P 500 returned 1.83% in November and 1.25% in December.

There are two notable outliers in this data: post-election performance in 2000 and 2008, years in which the economy was already under severe recessionary pressure. These were the only instances in the past 13 elections when the S&P 500 was negative for the year leading into the election. In 2000, the S&P 500 was down 1.71% through October, while in 2008, the market had already dropped by 38.72% amid the financial crisis. By contrast, the S&P 500 this year has achieved a positive return of 15.85% through October.

This historical context emphasizes that while political outcomes do shape some market responses, the post-election market performance is often resilient, with gridlock in Congress sometimes adding stability for investors.

While a relief rally is anticipated, it could be delayed if there is a prolonged period before the election winner is confirmed. Although the 2020 election required a few days to finalize, only the 2000 election—with the infamous Florida "hanging chad" recount—led to an extended delay before the winner was officially declared. This uncertainty, which persisted for over a month, continued to weigh on an already weakened S&P 500.

Our base case assumes a relief rally in the market following the election. However, we recognize that these results may be delayed due to the impact of mail-in ballots

Looking Past the Election

We continue to believe that the economy is edging closer to a recessionary period. We are getting closer and closer to our S&P 500 target of around 6100. This level would represent a an extreme Price to Earnings (P/E) ratio, leaving stocks vulnerable to an earnings slowdown.

While our Recessionary Checklist has not expanded over the last few months, we continue to see economic data that continues to weaken. Most recently the Oct Non- Farm Payrolls posted their weakest monthly number, +12,000 jobs created, in more than three years. October employment numbers look much worse when you factor out the growth in Government Jobs. Removing these jobs, the private payroll numbers for October would be a negative -28,000 jobs lost. The employment market continues to paint a picture of a weakening economy.

Recessions & Bear Markets

Since 1960 there have been ten bear markets (stock market losses greater than 20%), while the economy has experienced a total of seven recessions. It should be noted that we do not include the Covid bear market and recession of 2020, in these totals due to their extremely short duration.

While there can be bear markets without a recession, there cannot be a recession without a bear market. So, to better prepare for a recession it only makes sense that we develop an indicator to provide clues as to the beginning of a bear market.

NYSE Cumulative Breadth: A Key Bear Market Indicator

One of the most powerful tools available to investors is the daily New York Stock Exchange (NYSE) Cumulative Breadth readings. This metric calculates the net number of advancing issues minus declining issues each day on the NYSE, added to the previous day’s total. These readings provide an excellent measure of market strength or weakness by showing whether buying or selling predominates in the market.

Using the NYSE’s cumulative daily breadth, we have developed a key historical reference point to potentially help identify the onset of a bear market. In examining the last 10 bear markets, a consistent trend occurs: the NYSE cumulative breadth typically peaks well before the NYSE Index reaches its price peak. On average, breadth peaks 194 trading days before the Index price peaks. During these periods of negative divergence—when breadth is lower while the Index price is higher—the NYSE Index has historically gained approximately 9.84% before its final peak.

Currently, the NYSE cumulative breadth reached an all-time high on October 16th. Applying the average interval between a breadth peak and the NYSE price peak (or the high before a bear market), we estimate that a potential bear market, potentially leading into a recession, would not begin until the first or second quarter next year. However, this timeline is only a general guideline, and assumptions based on data from each past bear market are outlined below.

The shortest period between the peak in breadth and price was 45 trading days in 2022, while on the other side is the Tech Bubble where there were 450 trading days between the peak in breadth and the final peak in price.

Until we make a new high in NYSE breadth vs the current Oct 16th high, we will be on “bear market’ watch. We expect stock prices to continue higher in the short term, but will continue to scale back risk and trim shares accordingly if the breadth fails to make a newer high.

We will keep you updated on this call and provide additional data in the future.

Best,

Comments